Portfolio Review Q2 2024:

Emerging Markets Outperform,

US Stock Concentration Rises

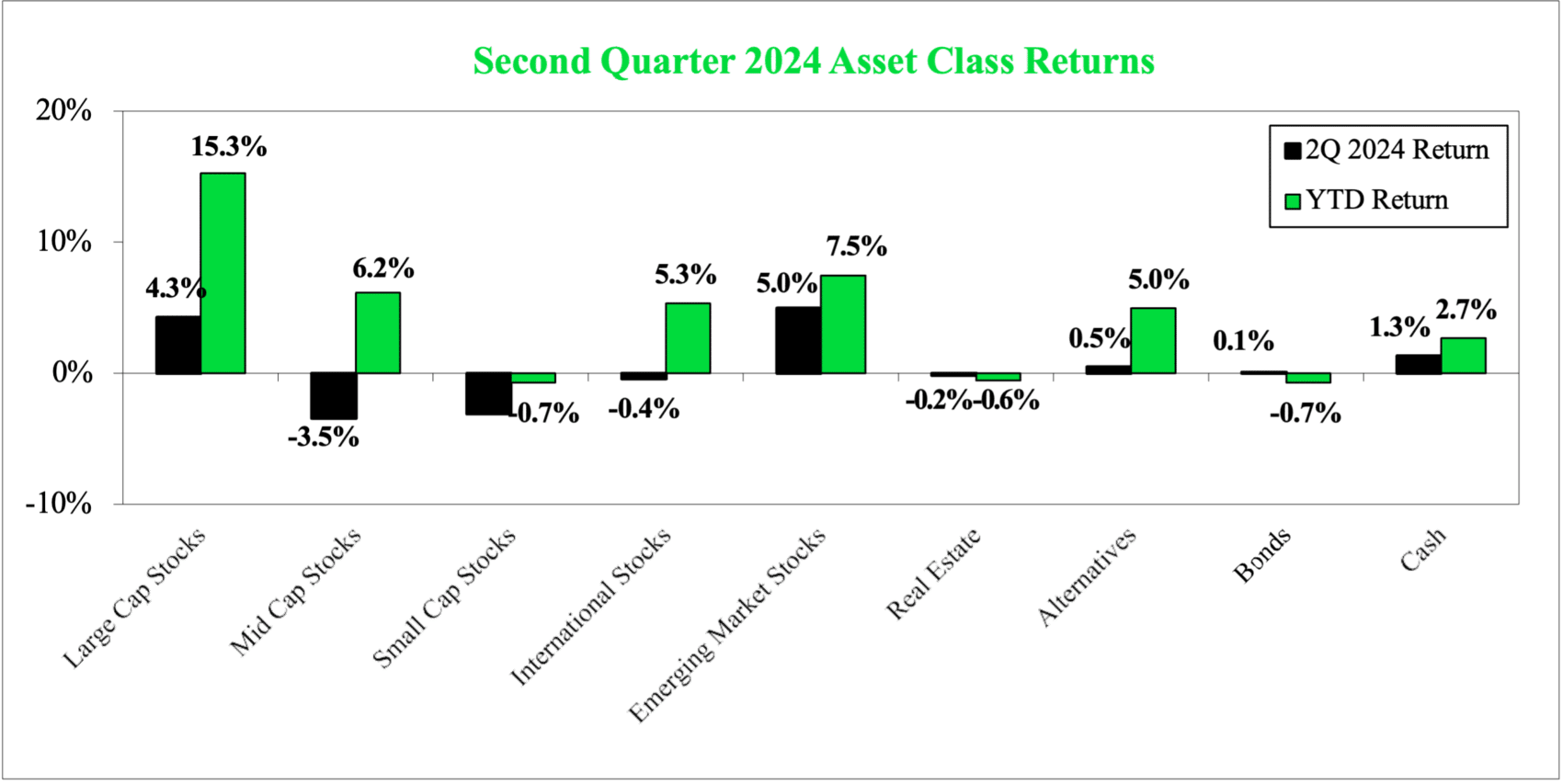

Stock returns were mixed in the second quarter. Surprisingly, emerging market international stocks led all other asset classes with a 5% return for the quarter. However, US large-cap stocks weren’t too far behind as the S&P 500 gained 4.3% and continued the trend of large company stocks dominating returns. Mid-cap, small-cap, and developed market international stocks all pulled back slightly after a positive first quarter. Bond returns were flat as the yield curve has remained fairly stable over the past few months.

EMERGING MARKETS PERFORMANCE LEADS THE WAY

Emerging market stocks were the top performers for the first time since the third quarter of 2020. Returns were driven by strong performance in China, India, and Taiwan, which collectively make up over 60% of the MSCI Emerging Markets index. All three countries generated returns of over 6%. This is a welcoming sign for emerging markets, whose returns have struggled relative to both the US and other developed market stocks for an extended period.

Does that mean the time has finally come for the emerging markets? Maybe. But even if it is a bit too early, there are numerous reasons to allocate at least a small percentage of stocks to emerging market stocks. One reason is that emerging market stocks pose a more significant risk than stocks in developed countries. Higher risk may sound undesirable, but this increases the potential for higher returns. And because emerging market stocks have fairly low correlation with large company stocks in the US, their inclusion can potentially reduce the risk of an overall stock portfolio.

Many emerging market countries are also projected to have higher, if more erratic, GDP growth rates than developed nations in the coming years. This projection is supported by higher expected population growth and relatively low national debt to GDP levels, among other factors.

Not only are growth expectations higher for emerging market nations, but valuations for these stocks are also lower, as the core emerging markets index trades at around 15x earnings while the S&P 500 approaches a Price/Earnings ratio of 26x. Strong growth expectations and attractive valuations are a nice and increasingly rare combination in today’s stock market. Emerging market stocks are notoriously volatile, but with a little patience, we see outsized rewards in the coming decade.

Large cap, mid cap, and small cap stocks are represented by the S&P 500, 400, and 600 indices. International and emerging market stocks are represented by MSCI indices. Real estate is the Dow Jones Real Estate index. Bonds are the Bloomberg U.S. Aggregate Bond Index. Alternatives are represented by the HFRI Fund Weighted Composite Index. Cash is the yield on the 3-month T-Bill.

US STOCK MARKET CONCENTRATION CONTINUES TO RISE

Mega-cap stocks continued to best all other US stocks this quarter. NVIDIA led returns, whose 150% gain year-to-date has contributed 30% of the S&P 500’s growth this year. As a comparison, the smallest 490 companies in the S&P 500 have contributed less than 29% of the index’s returns. The narrowness in today’s market has resulted in an extreme level of concentration and, therefore, risk. The top ten largest companies now make up over 35% of the index, far exceeding the Dot-Com bubble’s peak

concentration of 27% and rivaling the concentration levels during the tech boom of the early 1970s right before the “Nifty Fifty” stocks began to underperform the broader market.

Today’s top ten US stocks by market cap not only make up a large percentage of the index but are also very expensive, with an average Price/Earnings ratio of over 50x, almost double the P/E ratio of the overall S&P 500. This combination of high concentration and valuations is concerning for US markets. Historically, narrowly led technology booms did not end well.

We often hear the justification that today’s top performers are nothing like the top stocks in the late 1990s because today’s stocks are hugely profitable, stable companies versus the start-up internet stocks of the prior cycle. However, that doesn’t mean there isn’t downside risk. Solid companies can still see their stock prices run away from fundamentals, which is exactly what happened in the

1970s. The Nifty Fifty stocks of that era were solid, blue chip, growth companies. That didn’t stop them from dropping 50% when the bear market arrived.

Perhaps the excitement around AI’s potential warrants some stock price premiums for companies able to capitalize on new technologies. However, that was also the promise of the internet era. And while the internet revolutionized the way we work and improved productivity, it didn’t prevent a nasty bear market and economic recession.

While we cannot predict if or when we will see a similar pullback from the current AI mania, the parallels in risks from high valuations and concentration are becoming more apparent. With the growing risks, it becomes even more important to avoid the herd mentality of chasing the highest return stocks and remain disciplined in academic and time-tested investment strategies.

BONDS AND ALTERNATIVE INVESTMENTS

Bond returns were positive for the quarter, but just barely. The Bloomberg Aggregate Bond Market Index gained only 0.1% for the quarter, while short-duration bonds fared slightly better. Over the quarter, the 10-year Treasury bond yield increased from 4.2% to 4.35%. Rising interest rates are bad for bond prices, so any creep-up in rates holds bond returns back. The yield curve remains inverted, so shorter-term bonds are generally outpacing long-term bonds. At the extreme, 3-month Treasury bills have had some of the strongest returns lately. It is tempting to sell out of longer-dated bonds and just buy T-bills, but if interest rates decline from here, we would miss out on some return potential. We would also be unable to reinvest the proceeds from maturing T-bills into new bonds with similar yields. So, while we remain defensively positioned with our bonds, we have resisted the temptation to effectively move to cash. Longer-term, we expect this will provide the best return potential.

Returns for the various alternative investment strategies saw little change this quarter. Style premia was the best-performing mutual fund with a return of 2%, while managed futures performed the worst with a loss of -1.1%. Despite the lack of returns for the quarter, alternatives are still strong for the year. Both style premia and managed futures have posted double-digit returns year-to-date, while all the liquid strategies we employ have been positive.

The liquid alternatives portfolio, in aggregate has a year-to-date return near 10% and has generated annual returns at or around that level since the beginning of 2021, quite a turnaround from its performance in the late 2010s.

Overall, returns for stocks, bonds, and alternative investments were minimal in either direction this quarter.

Economic signals were also mixed:

- GDP growth slowed but remains positive.

- Unemployment edged up but remains historically low.

- Inflation crept lower but remains above target.

Investors still have much to worry about, but that was also true last year, and stocks have returned over 20% since then. So, it is best to tune out the economic ups and downs, global conflicts, and upcoming elections, as hard as that can be, and remain focused on your long-term investment strategy.

Beware Annuities:

Why High-Net-Worth Investors Should Avoid Annuities

While annuities can be a part of some financial plans, in most cases, better options are available for our clients. We carefully evaluate each situation to determine if an annuity truly aligns with their retirement goals. Often, we encounter new clients who come to us with annuities as part of their financial plans. While occasionally it makes sense, the vast majority of the time, we start calculating what it will cost to surrender the contract. Recognizing that annuities infrequently have their place in a well-thought-out financial plan, we’re just not big fans.

Four good reasons against buying an annuity:

- Annuities are challenging to understand: Annuities are not homogenous animals and can be quite complex and difficult to understand. There are many different types and contract terms, such as immediate fixed annuities, variable annuities, deferred annuities, and indexed annuities, each with unique contract terms. These complexities are detailed in the paperwork you complete upon purchase, but unless you have legal expertise, you may find it challenging to comprehend all the terms. This complexity often leads to misunderstandings and potential financial pitfalls.

- Annuities can carry high costs: There are a host of fees and expenses with annuities, including administrative fees and mortality and expense fees that can add up to well over 1% just to have a fairly plain annuity. Suppose you want all the bells and whistles, including the potential for stock-market-like returns with downside protection. In that case, you will have to pay for additional riders, often bringing total costs north of 3%. Those substantial costs all erode your long-term return potential.

- Hidden costs- Annuity surrender charges, penalties, expense ratios: There can also be other hidden costs with annuities, particularly if you ultimately change your mind and want to get out of an annuity. There are usually surrender charges that can run as high as 7% of the purchase price if you decide to sell within seven years of the initial purchase. The IRS can also levy penalties if you sell out before you turn age 59 ½. These costs are quite significant, so it is best to be absolutely certain before entering into an annuity contract.

- Tax Inefficiencies & Consequences of Annuities: The most significant detriment to annuities, at least from our perspective, is that they are tax inefficient. That may sound odd since annuities are often sold with the promise of lower tax bills. However, in the long run, we find the downsides to the tax treatment of annuities too onerous to accept. The most problematic is that gains on annuities are treated as ordinary income, and they do not qualify for stepped-up basis upon death. That means someone will pay tax on your annuity, either you or your heirs, and you’ll probably pay at a higher rate than you would on a more traditional investment portfolio. Tax treatment must be considered before purchasing an annuity, and spoiler alert: the math rarely works.

There’s an old adage among skeptics that annuities aren’t bought, they’re sold. That means aggressive insurance or investment salespeople push the products, often on unsophisticated buyers, with the promise of guaranteed lifetime income. While that may not be an outright lie, there are many more details to consider before plopping down a chunk of your retirement savings into an investment vehicle that can be difficult and expensive to unwind. While buying annuities may seem attractive due to promises of guaranteed income, it’s essential to consider their downsides carefully. High-net-worth investors typically don’t require the “benefits” that annuities offer, as they generally have sufficient funds to sustain their lifestyles without incurring significant costs and taxes for unnecessary guarantees. Our firm prioritizes transparency and personalized financial planning to ensure our clients make informed decisions aligned with their long-term goals. If you’re considering an annuity or any other financial product, we encourage you to consult with a trusted financial advisor to explore all your options and choose the best path for your retirement.

Election 2024:

Market Noise vs. Market Sense

In this short video, our Portfolio Manager, Mark Armbruster, CFA dives into the impact of elections on investing, just in time for the 2024 U.S. Presidential election. With over 60 countries holding elections, including major players like India and the E.U., 2024 is a pivotal year. Should you adjust your investment strategy? History suggests otherwise. While election years can be volatile, the market tends to correct quickly, regardless of the winning party…

Click the link below to watch the video on YouTube:

www.rdgcapitalmanagement.com

aryan@rdgcm.com

585.673.2683